95 Sample Non Profit Donation Acknowledgement Letter

Samples of written acknowledgements.

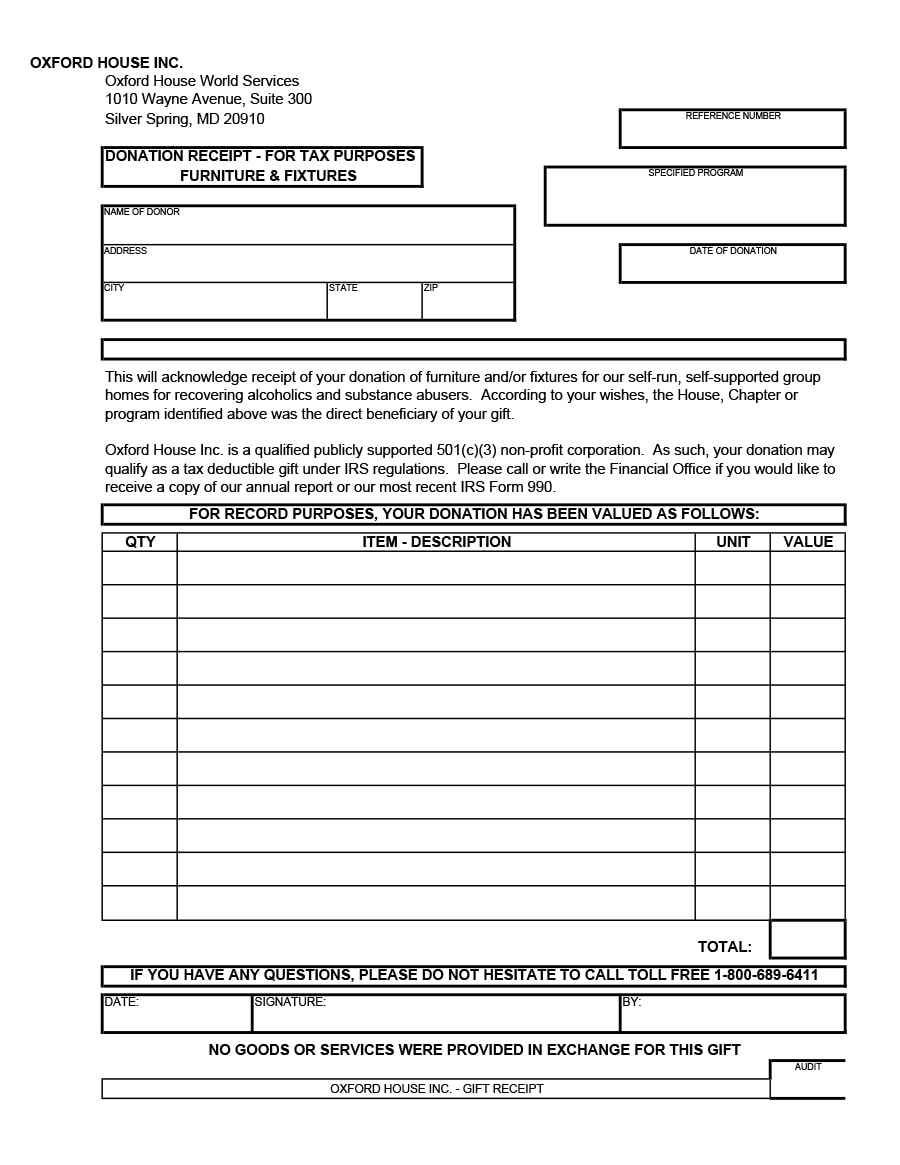

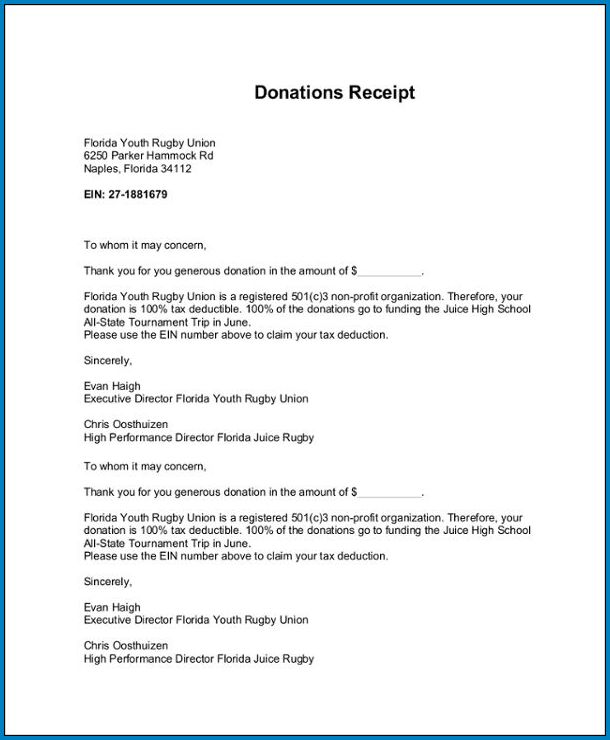

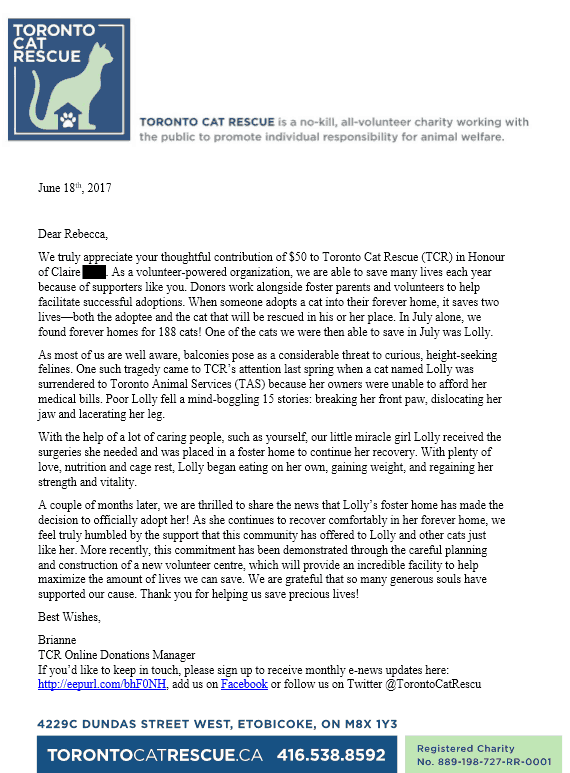

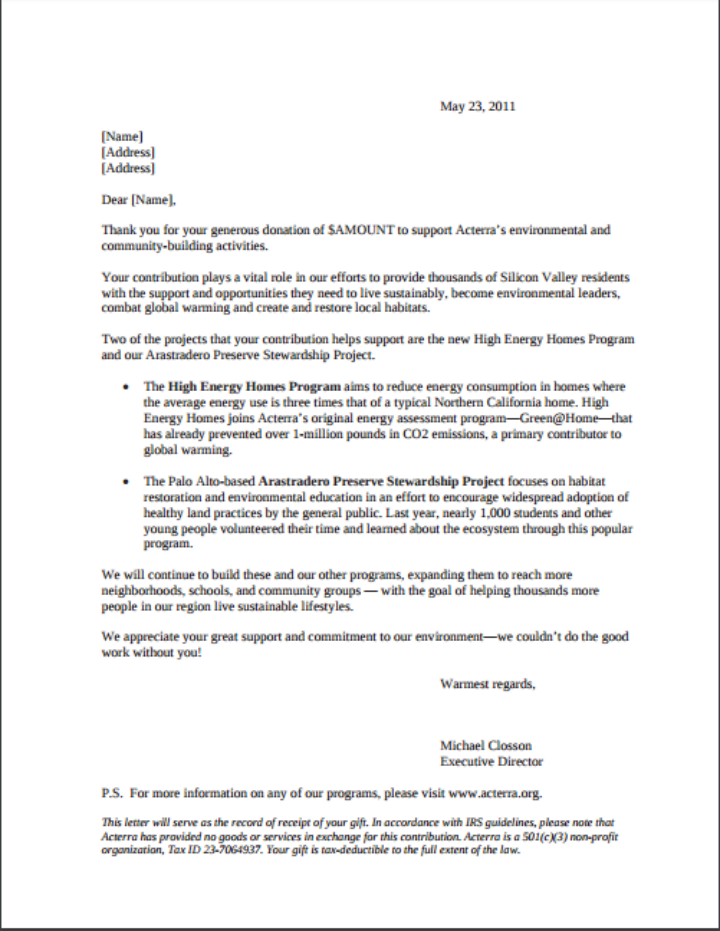

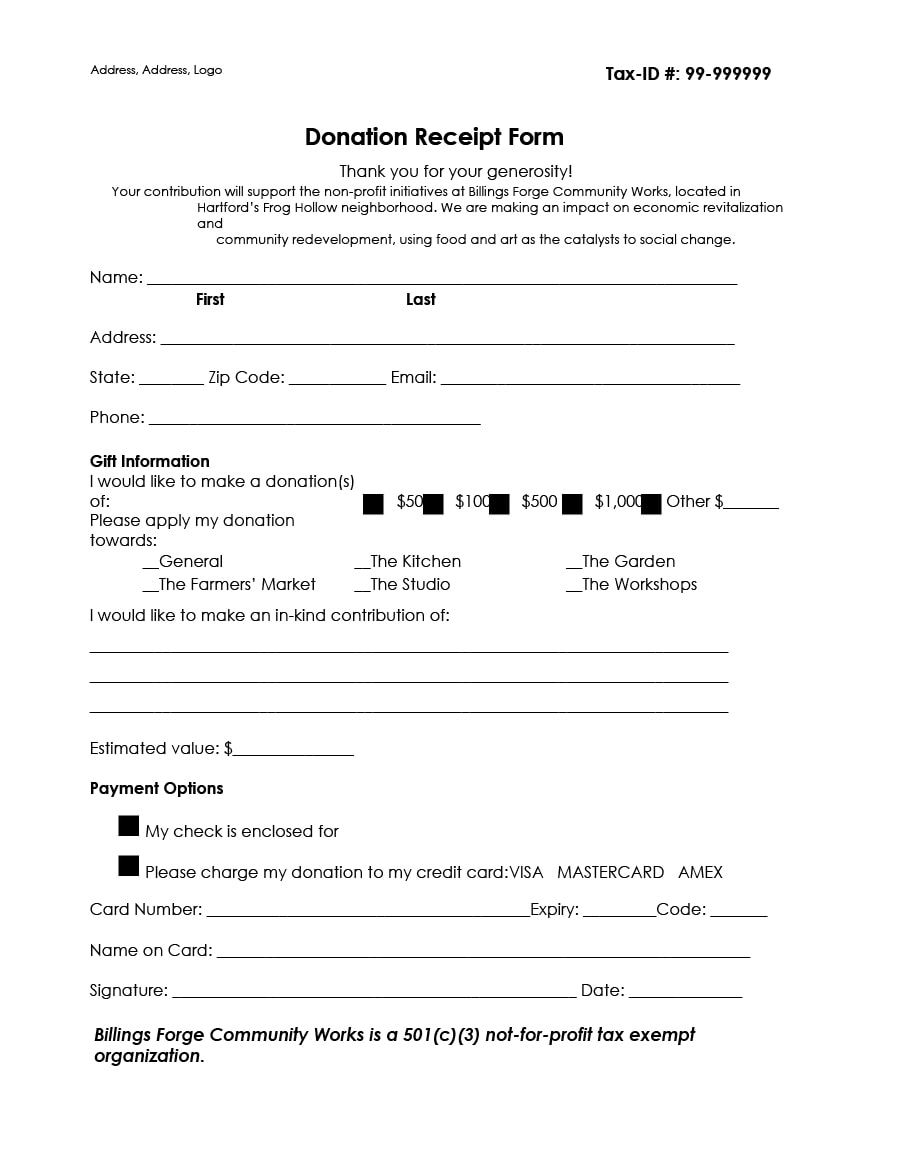

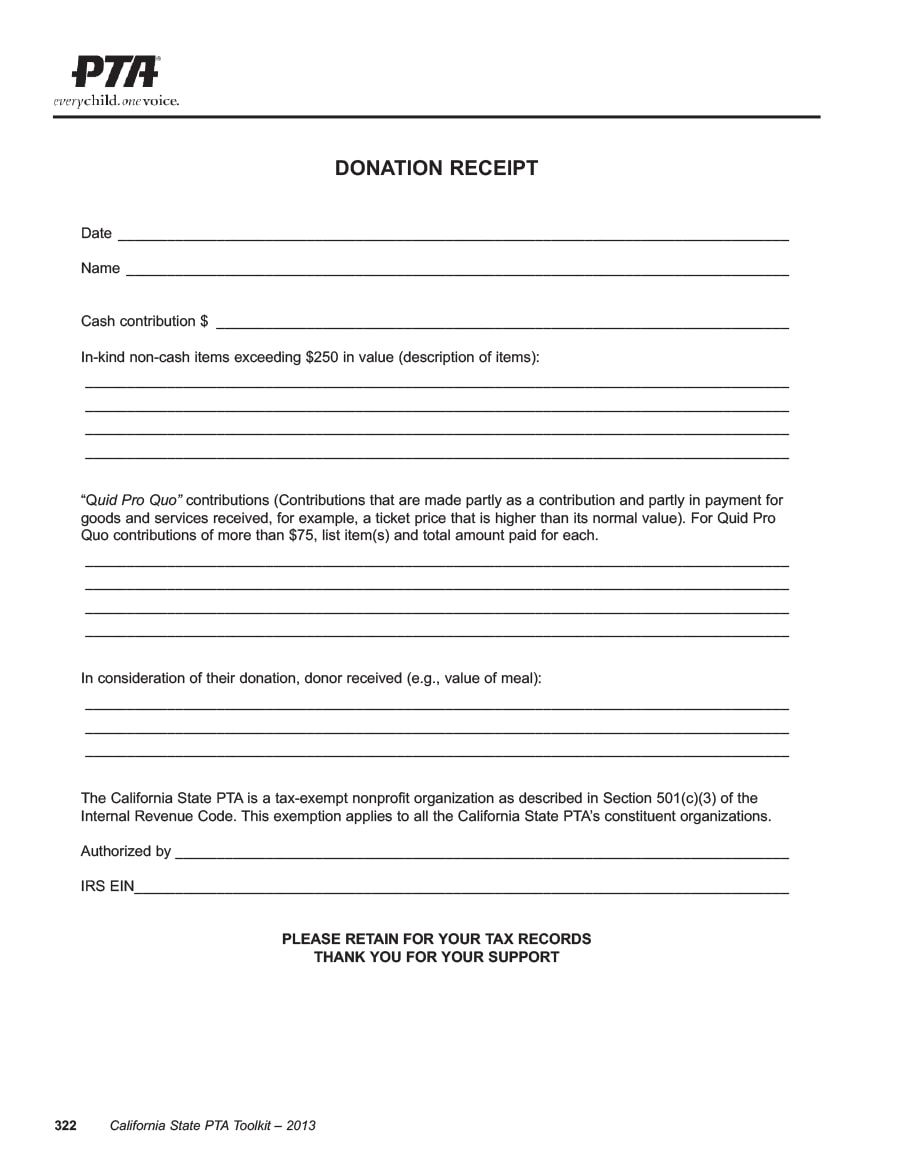

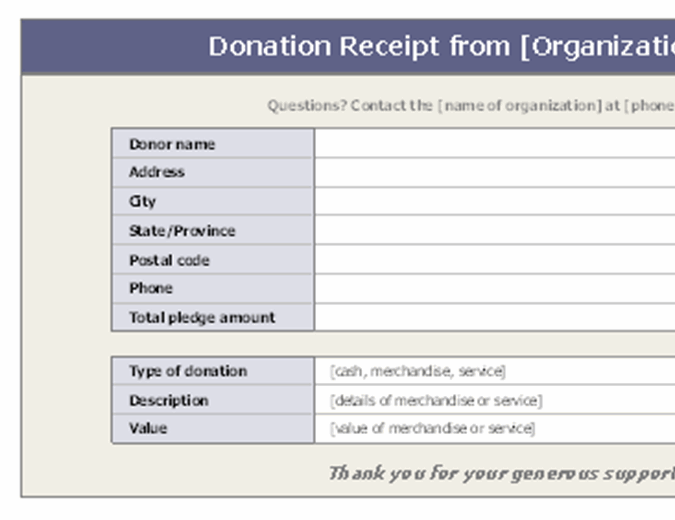

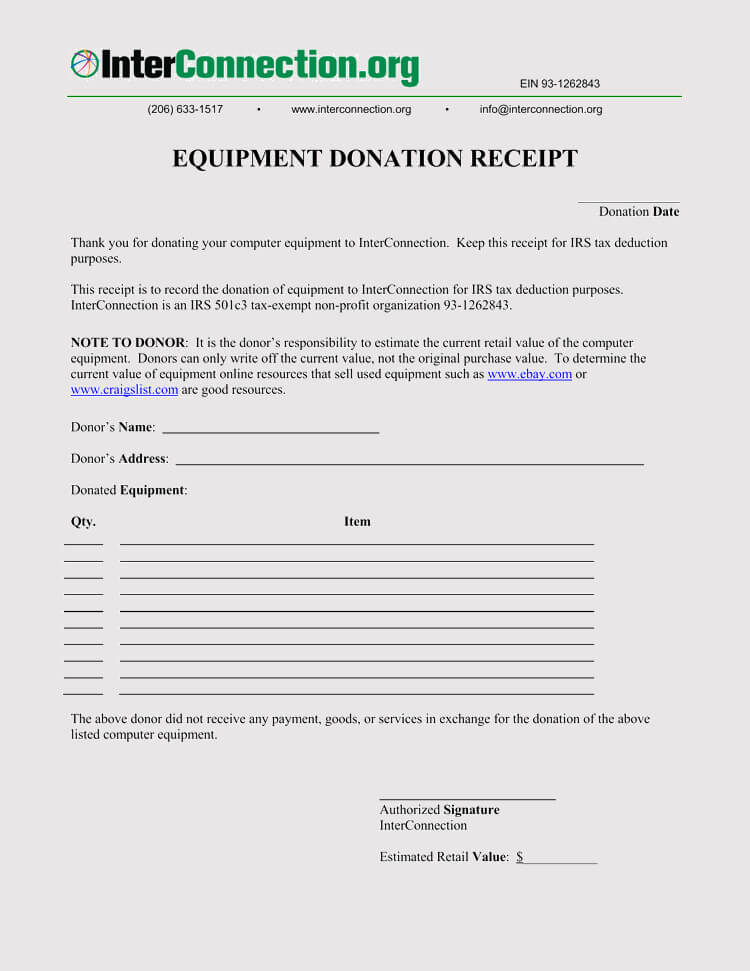

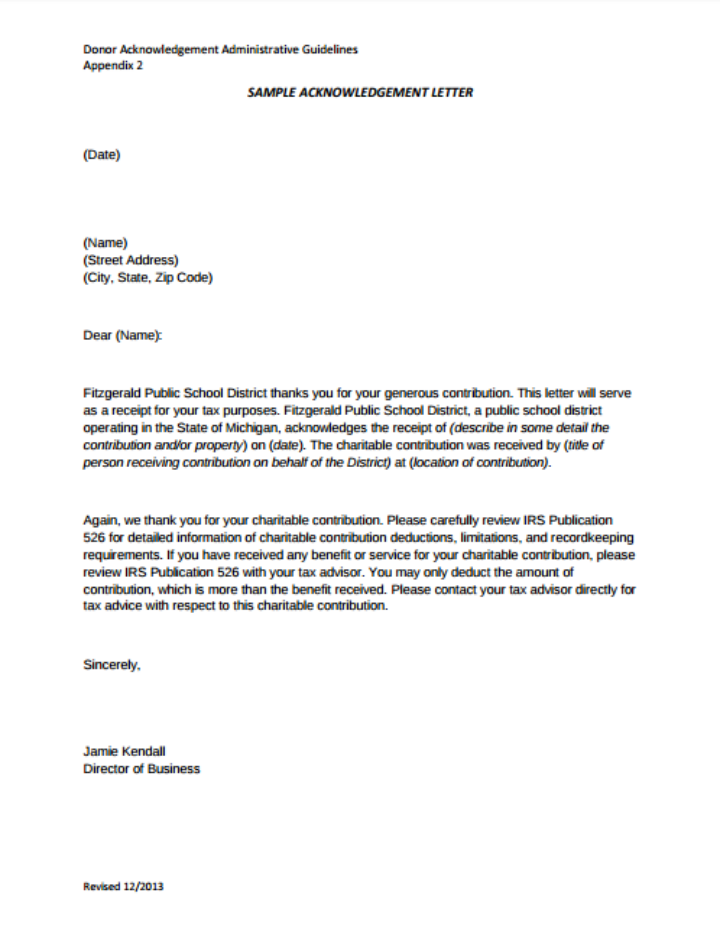

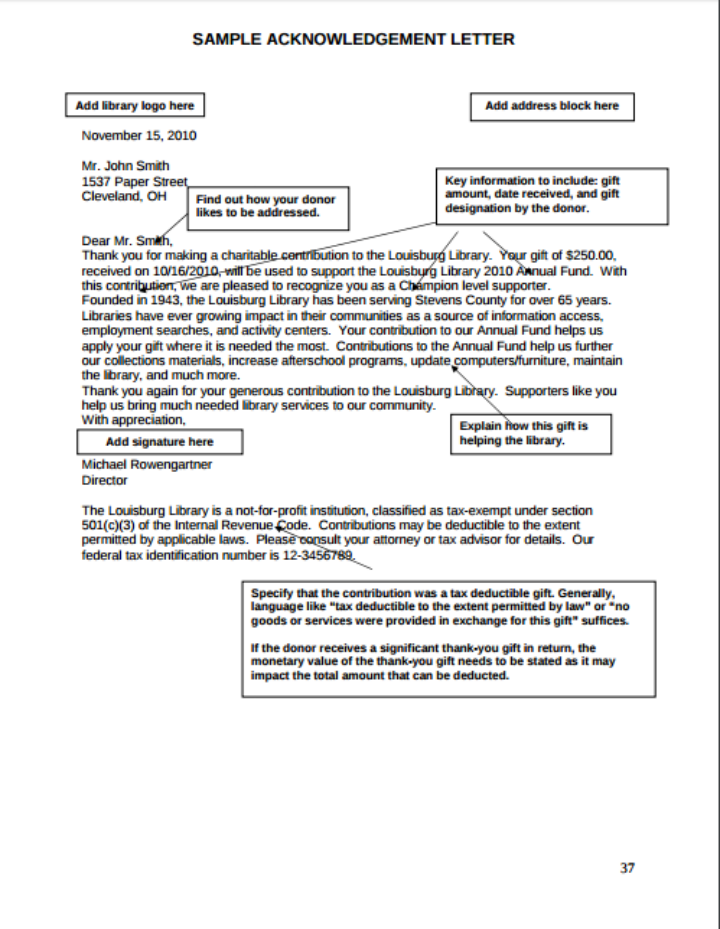

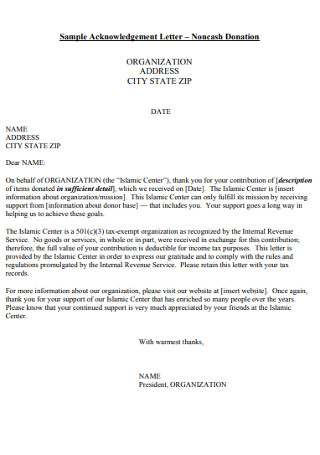

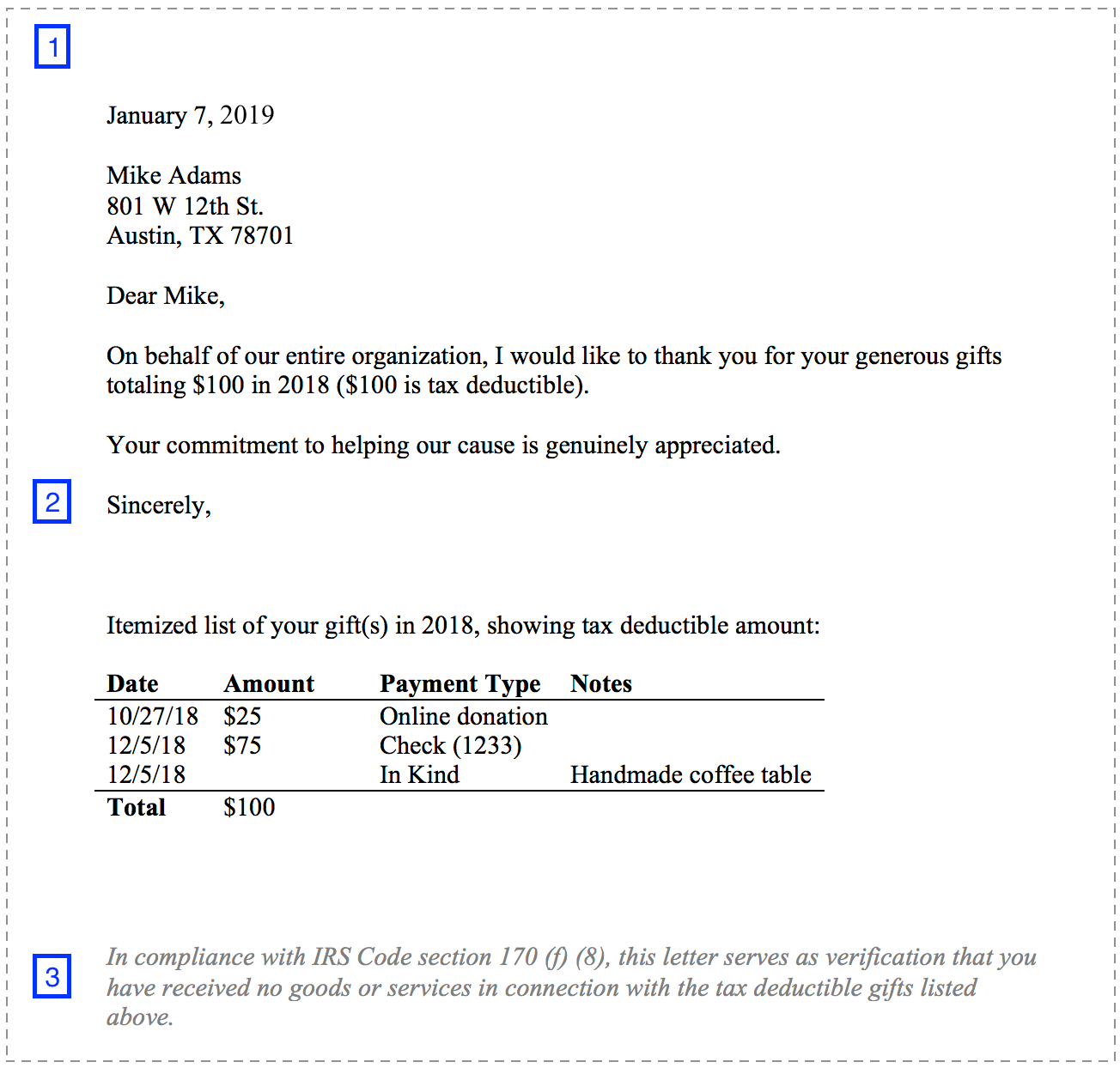

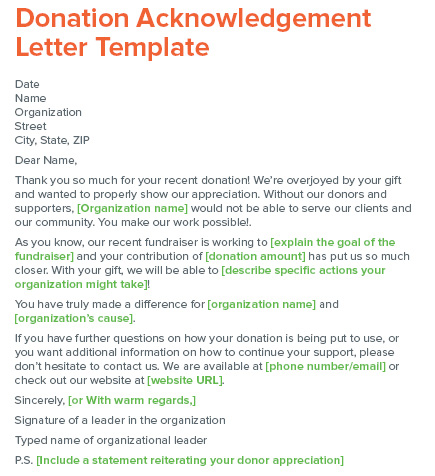

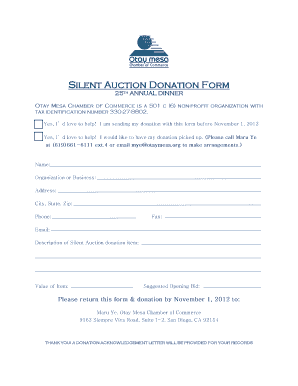

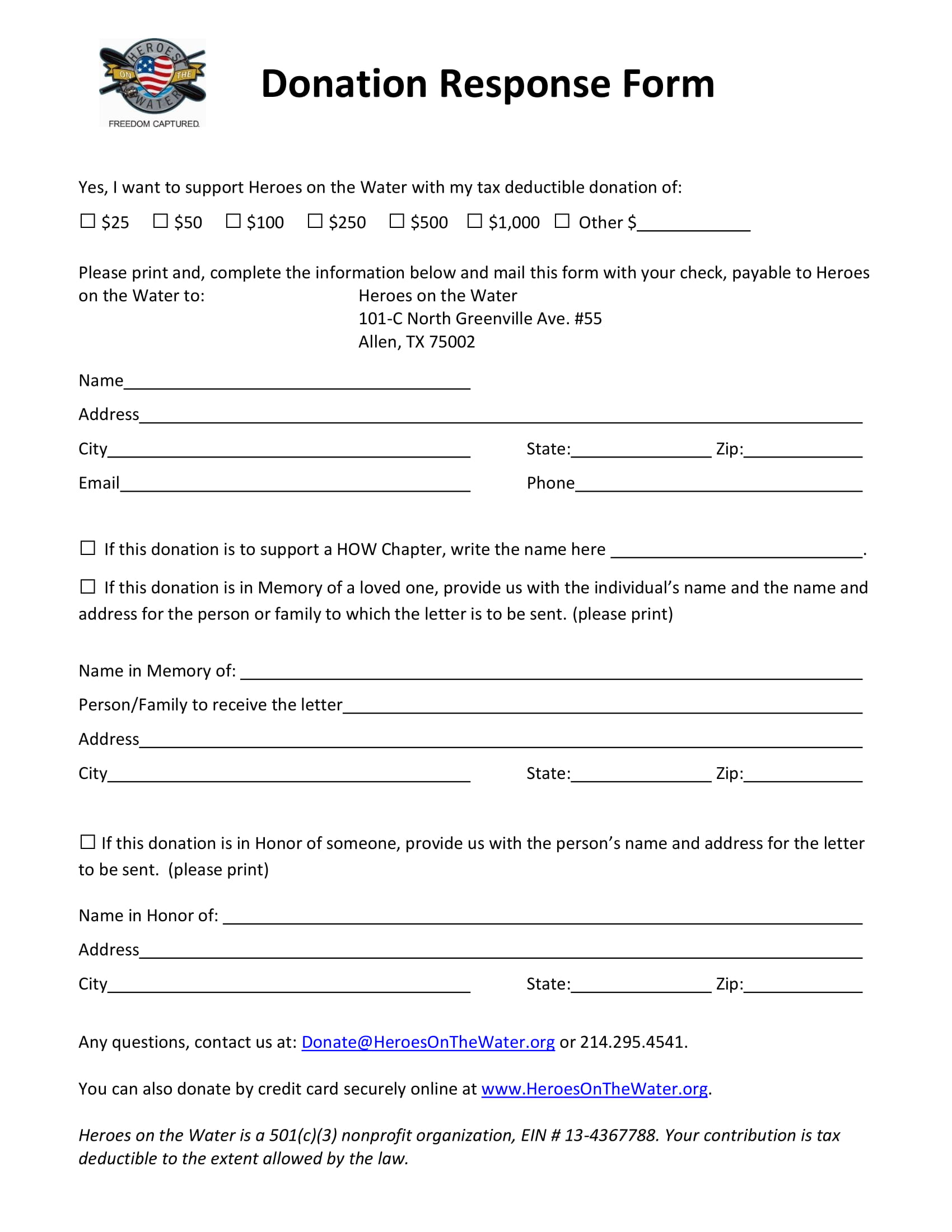

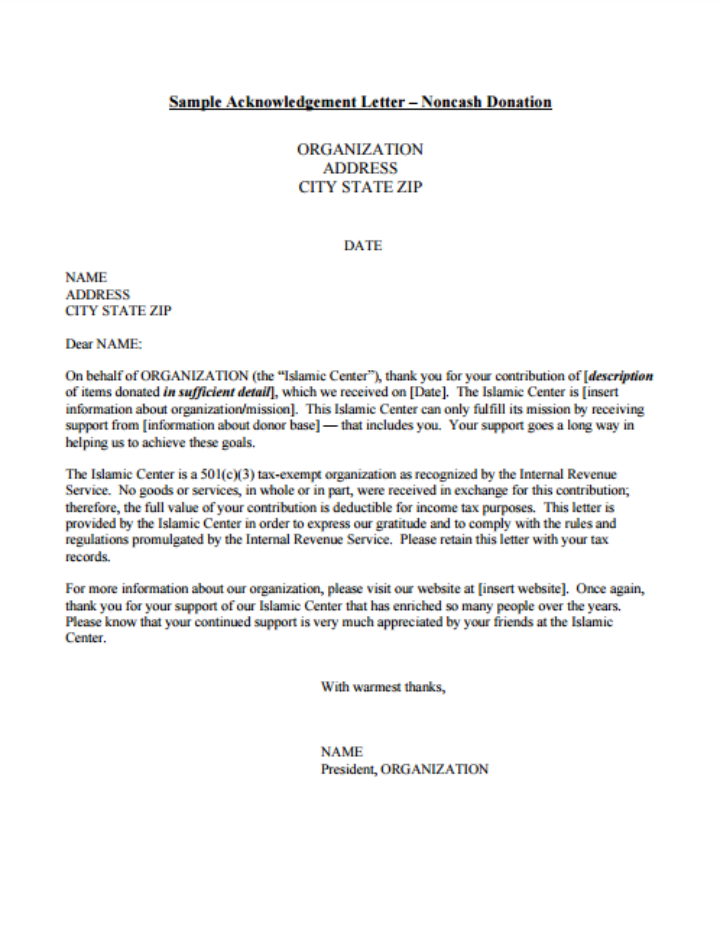

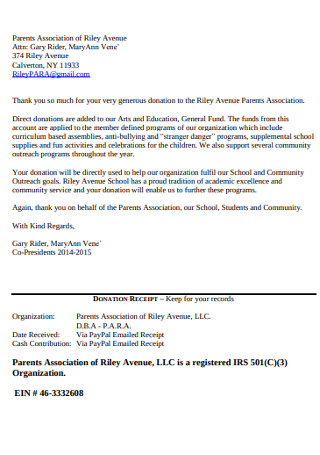

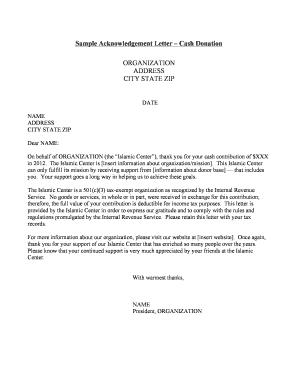

95 sample non profit donation acknowledgement letter. Tax exempt nonprofits have certain requirements to follow including providing donors with a donation receipt often called an acknowledgment letter. A donation acknowledgement letter is used by the receiver of the donation to assure the sender that they have already received either the amount of money given or any kind of help being extended by the person who gave the donation. Your ein employer identification number so that the donor may verify the organizations status as a recognized nonprofit organization or advocacy group. Now that youre more aware of the nuances of this kind of letter you also find yourself in a better position to make smarter choices.

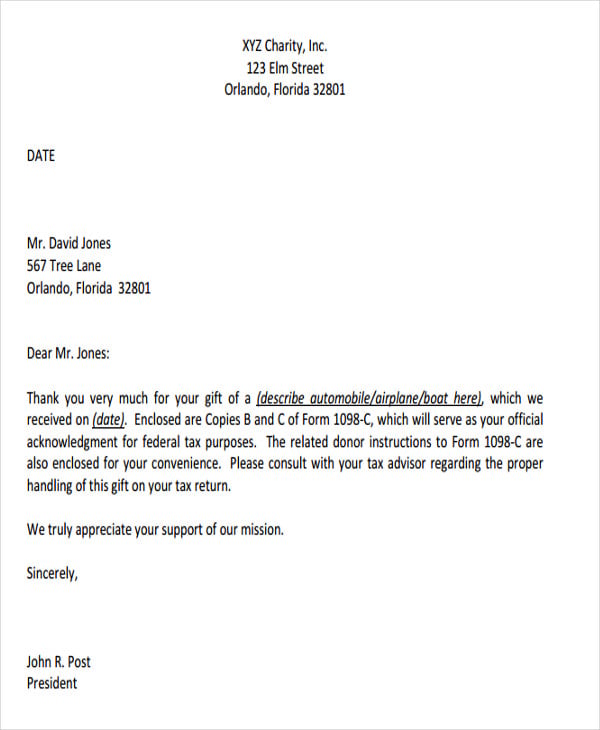

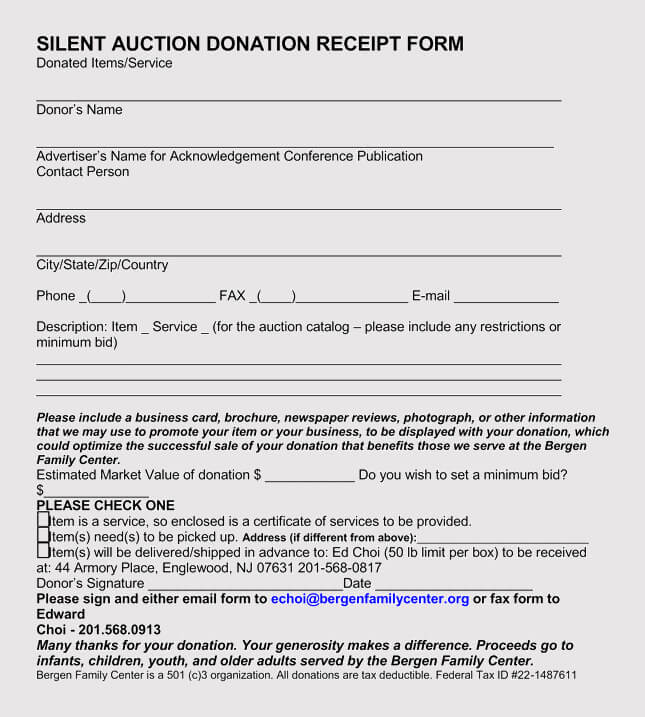

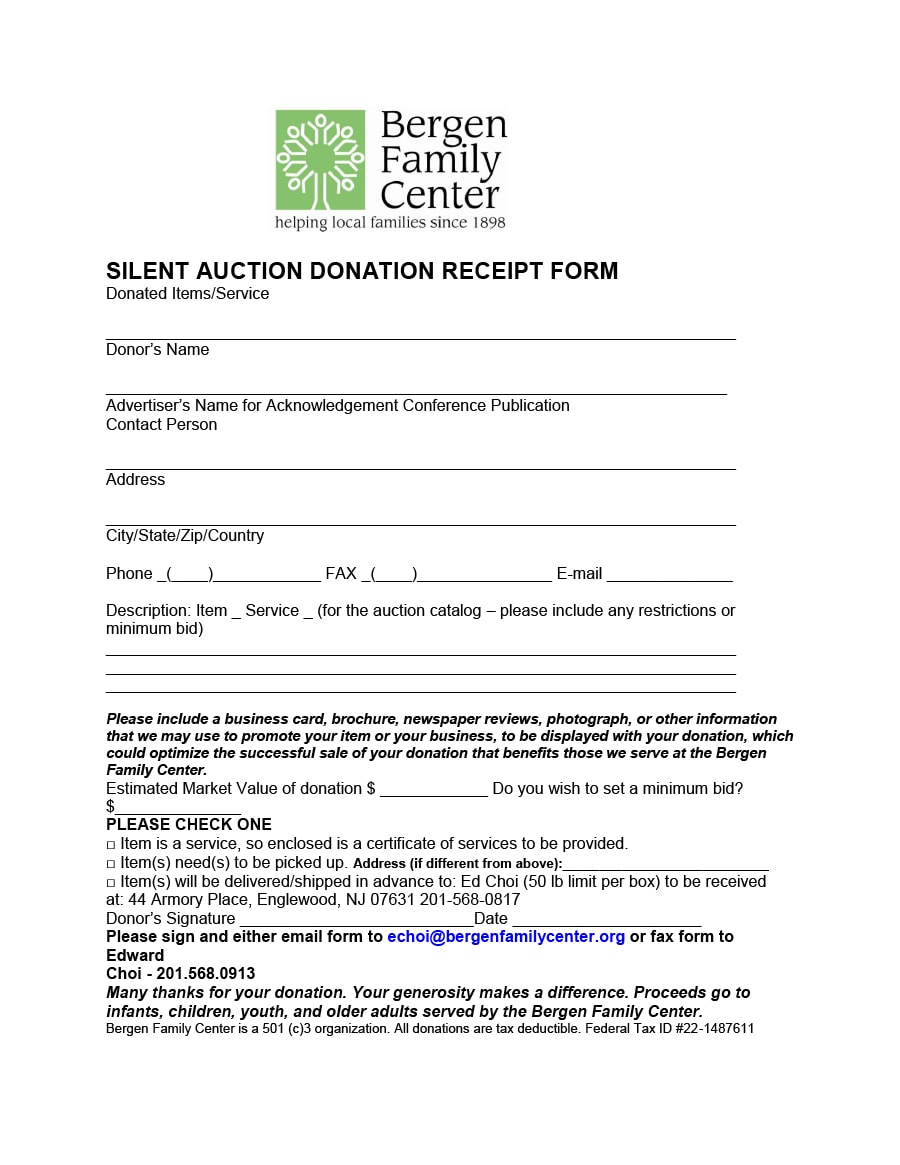

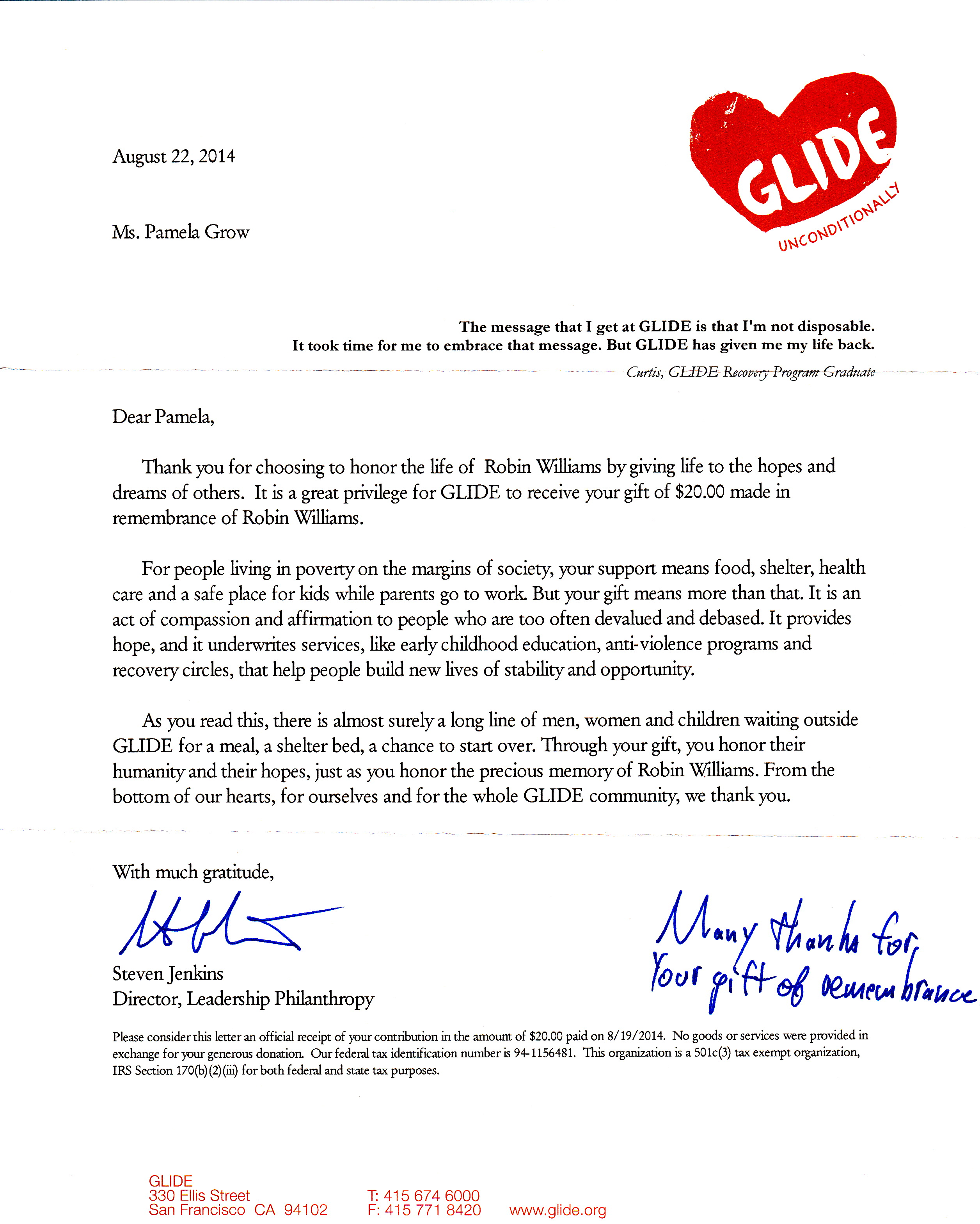

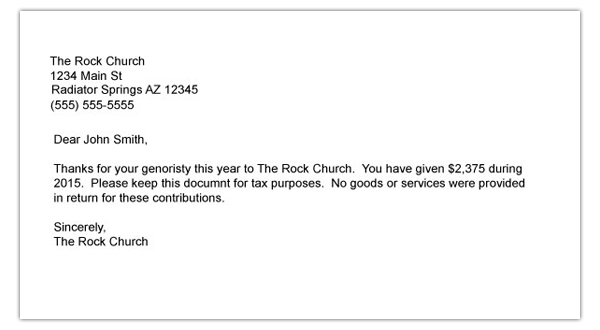

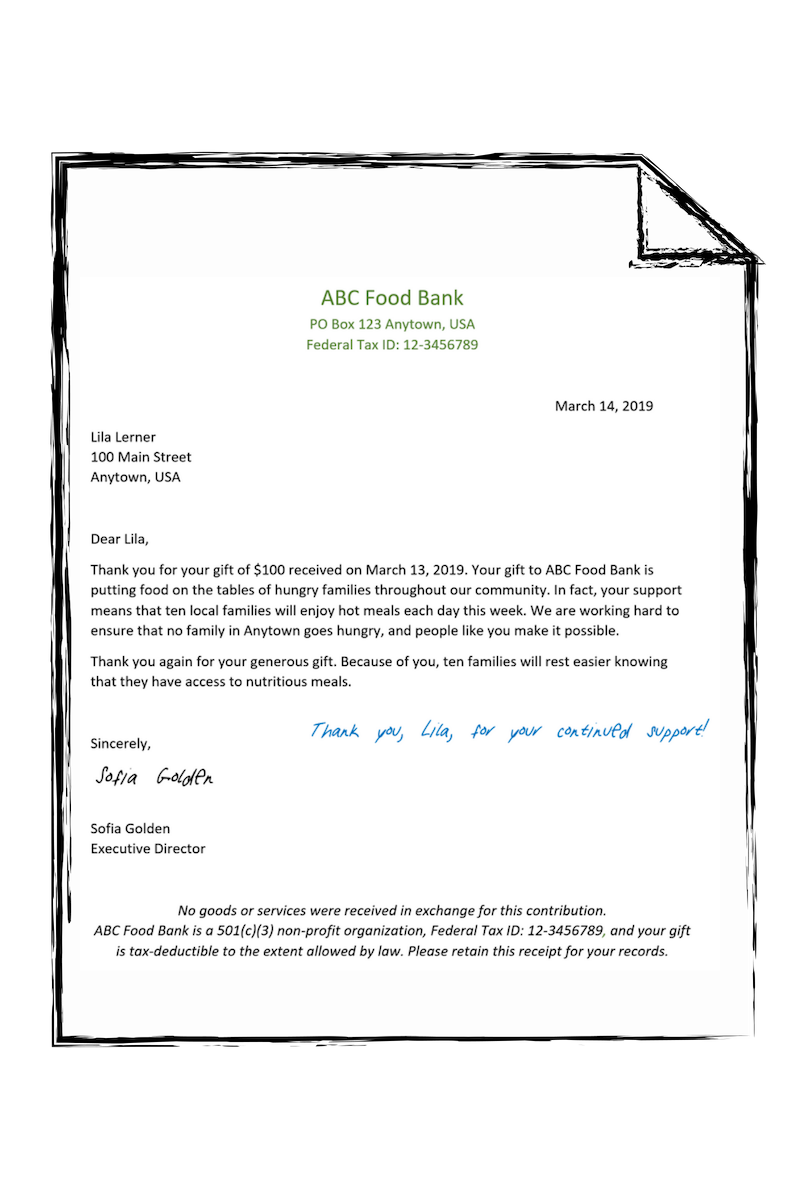

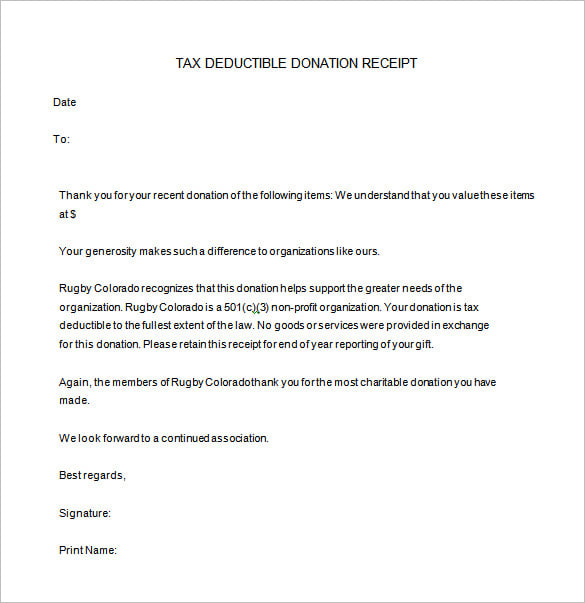

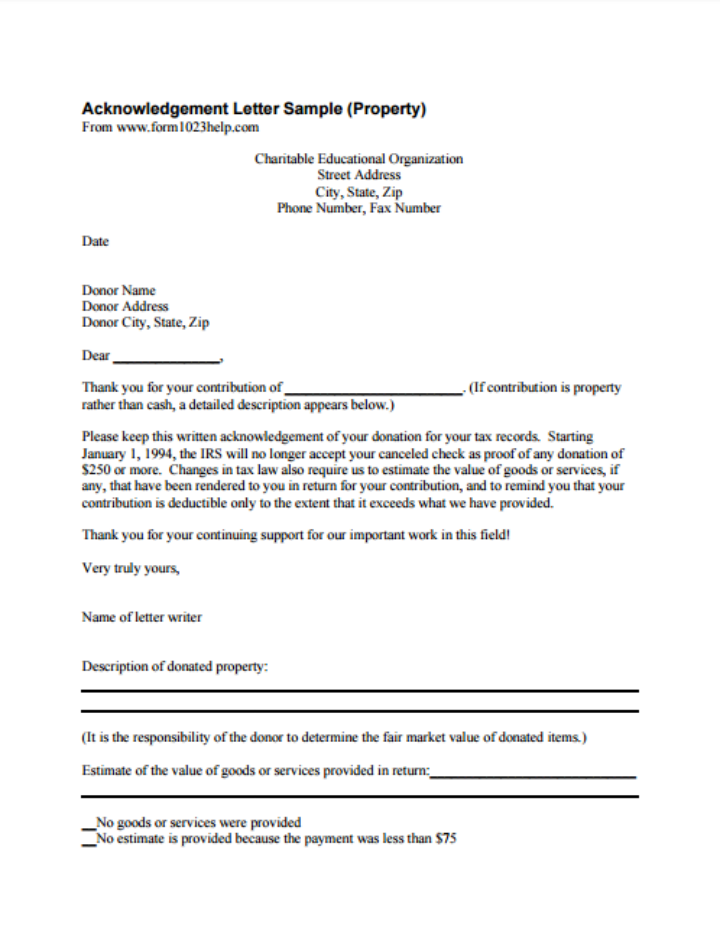

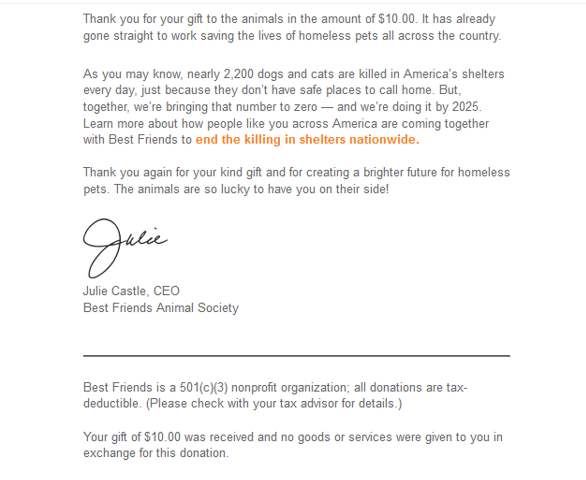

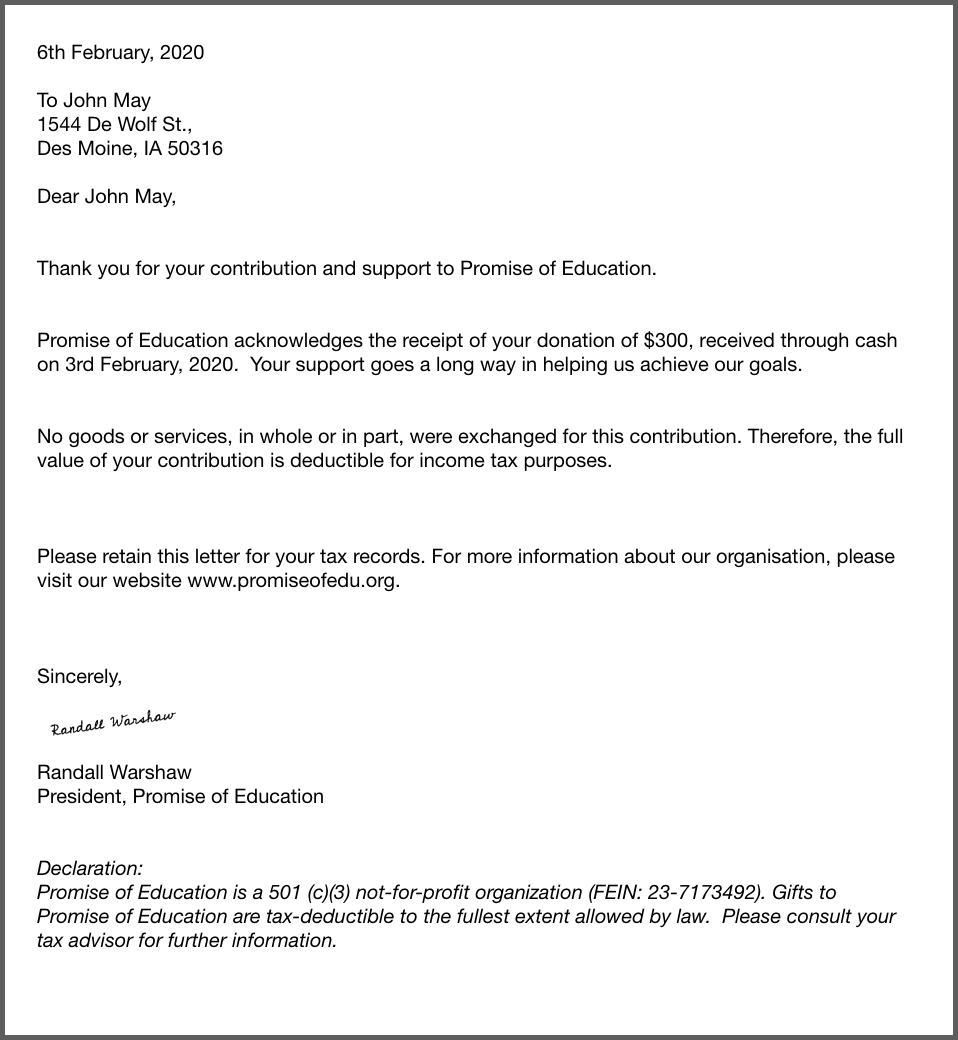

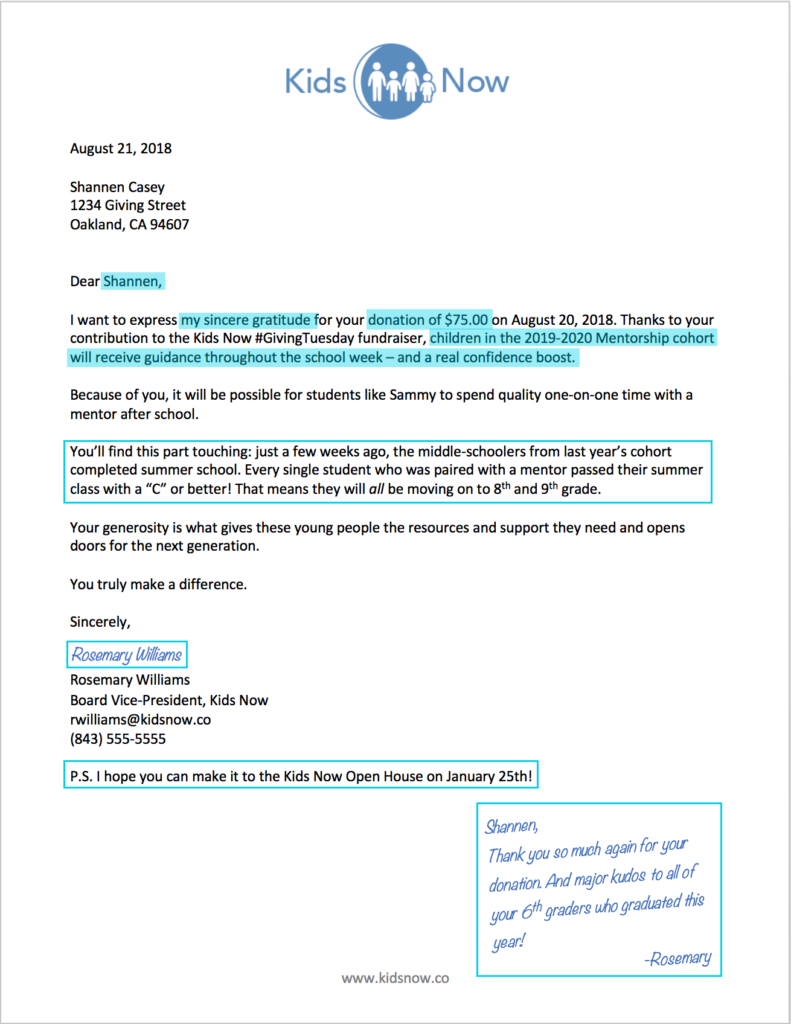

With a well crafted donation request letter at your disposal theres no telling who you can convince to contribute. Please keep this donation letter for your tax records. For donations of 250 or more the irs no longer accepts cancelled checks as proof of donations made. There was a lot of exciting stuff happening at the organization but youd never know it from the boring dry and uninspiring letter they were sending in response to every donation.

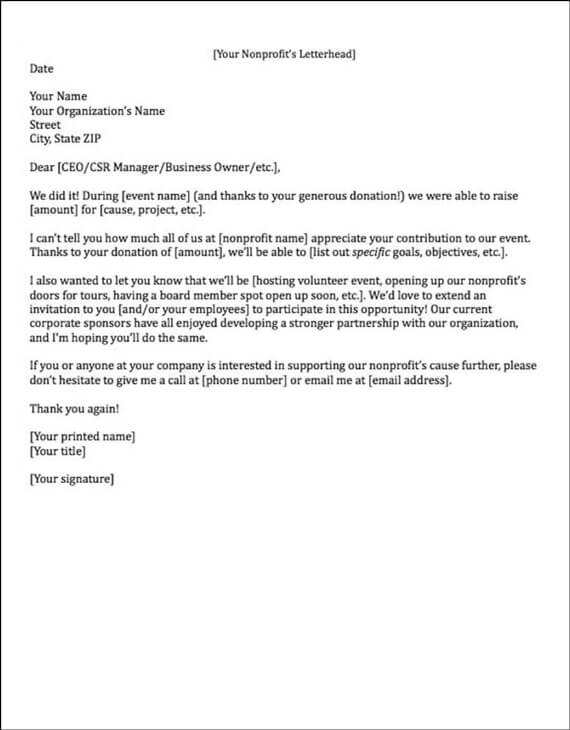

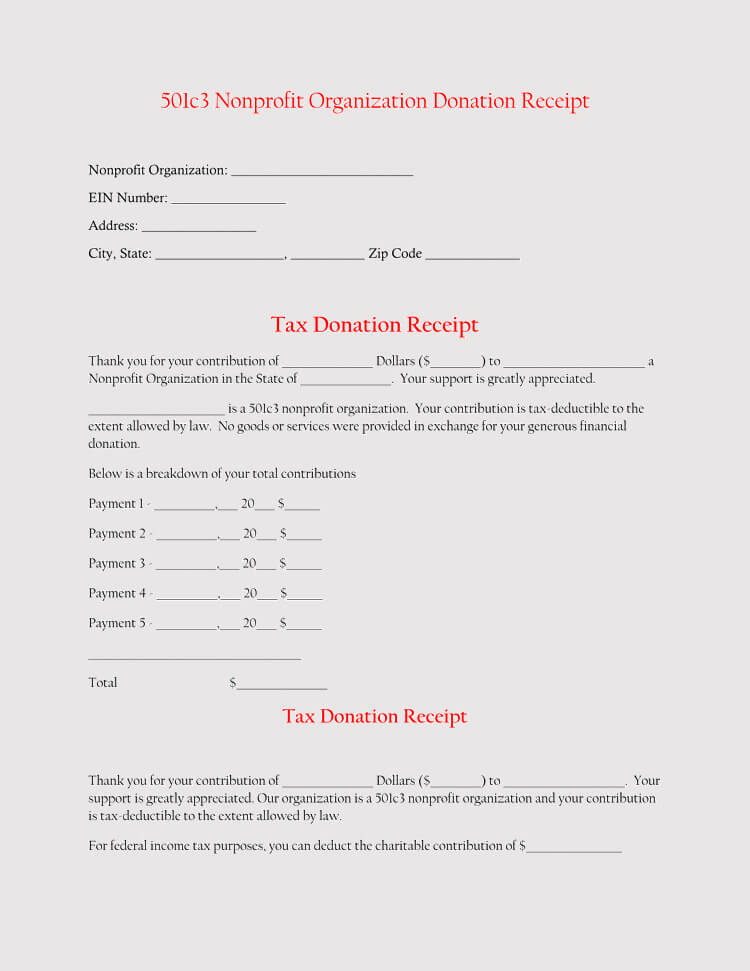

Donors giving more than 250 in a single contribution to a tax exempt nonprofit organization need a written acknowledgment from the organization to claim that deduction on their individual income tax return. If you have planned to host an event for raising fund then it will be a success only if more people attend it. So to write a successful invite asking for them to first donate their valuable time for your event and then if possible also. Our tax id number is.

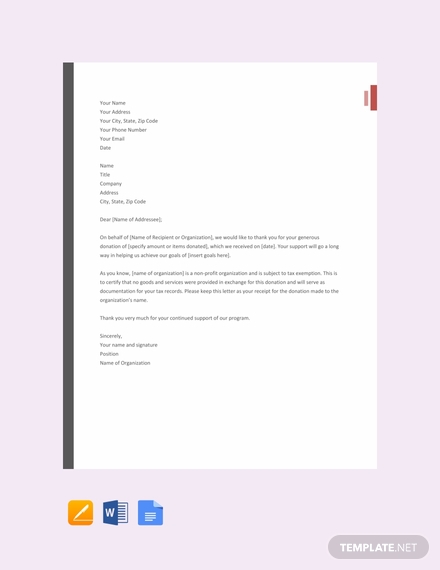

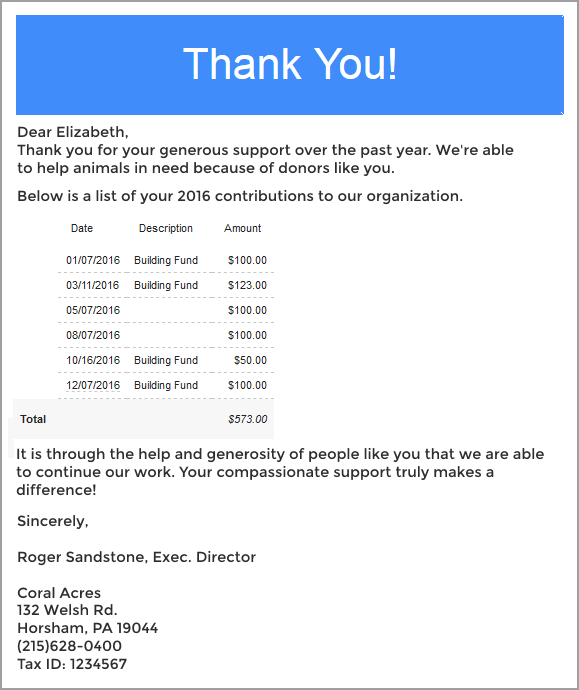

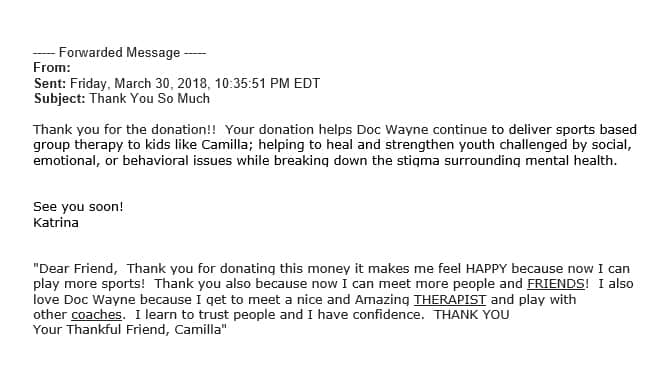

Donation letters can serve as the gateway towards opportunities that might not have existed otherwise. Zan was the new development director at a youth services organization. Making a donation letter is very important as it can provide all the information about the cause that you would like to champion. Non profit donation letter sample.

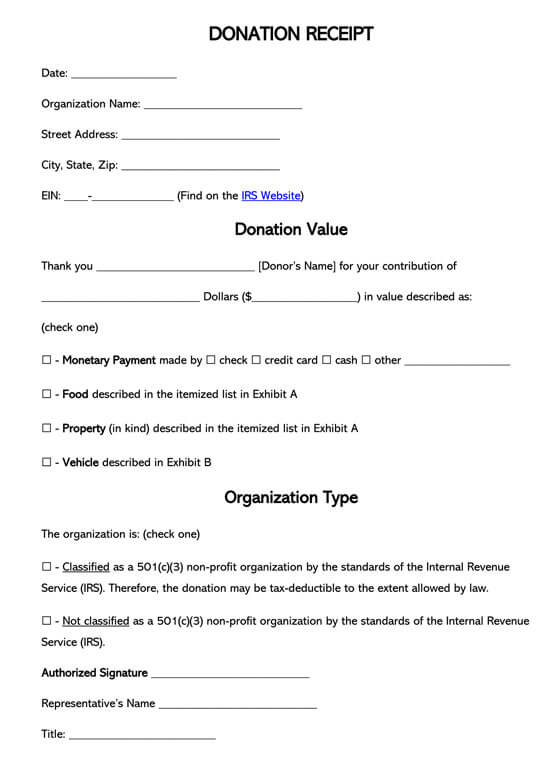

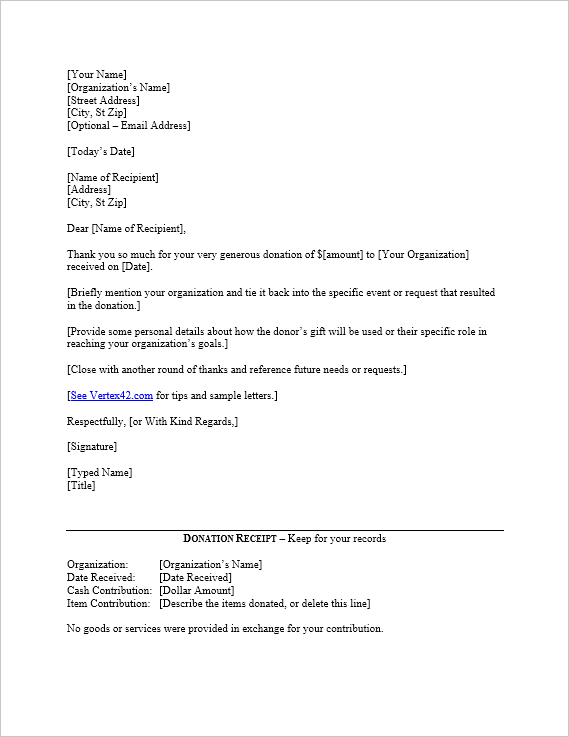

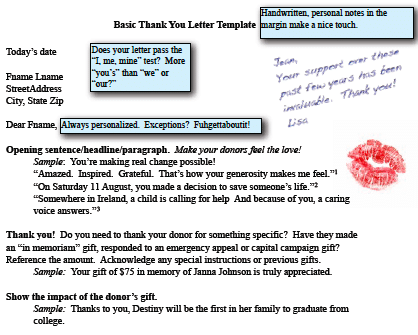

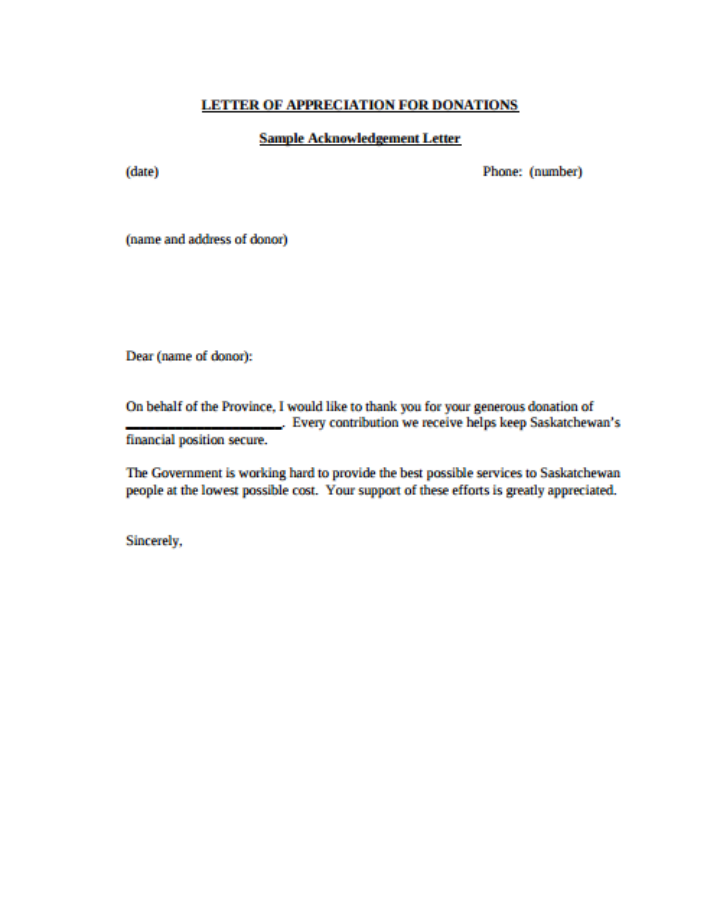

Your acknowledgment letter should include the following information. The donor may use this letter as proof of his or her contribution and claim a tax deduction. You must retain this written acknowledgement. Nonprofit donation letter via email sample.

Your nonprofits legal name and that it has tax exempt status as a 501 c 3. Thats why zan decided she had to change the donor thank you letter at her nonprofit. Some of the staff selected websites below contain samples. You can efficiently create a letter that can give you higher chances of getting donations.

In practice most charities send an acknowledgment for all donations even small ones. Your donation to our 501c non profit organization is tax deductible.

:max_bytes(150000):strip_icc()/2501851v1-5ba4cc3c46e0fb005044df8d.png)